choose the best scenario for refinancing answer

Choose the best scenario for refinancing. Choose questions that fit the mood of the people and the place youre asking.

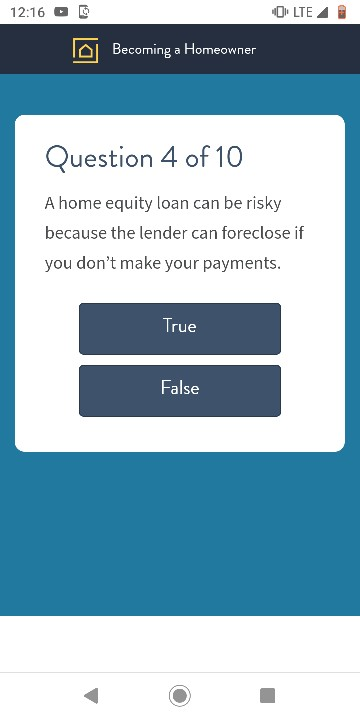

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

You have a current mortgage at 5 and have been approved for a new mortgage at 375.

. Choose the best scenario for refinancing Choose the best scenario for refinancing. Choose the best scenario for refinancing. The lower interest rate drops your monthly payment from 1013 to 898 a savings of 115 per month.

You have a current mortgage at 5 and have been approved for a new mortgage at 375. You have a current mortgage at 5 and have been approved for a new. Youll break even on the.

Choose the best scenario for refinancing. The lower interest rate drops your monthly payment from 1013 to 898 a savings of 115 per month. Youll break even on the closing costs in two years and.

The best scenario for refinancing is. Question 3 of 10 Choose the best scenario for refinancing. Youll break even on the closing.

Choose The Best Scenario For Refinancing Homeworklib A recent NFCC and Wells Fargo survey may have your answer. Question 3 Of 10 Choose The Best Scenario For Refinancing. Choose the best scenario for refinancing.

A You have a current mortgage at 5 and have been approved for a new mortgage at 375. 2 on a question. Youll break even on the.

Choose the best scenario for refinancing. If you have an. Youll break even on the closing costs in two.

You have a current mortgage at 5 and have been approved for a new mortgage at 375. You have a current mortgage at 5 and have been approved for a new mortgage at 375. Choose the best scenario for refinancing.

The best scenario for refinancing. You have a current mortgage at 5 and have been approved for a new mortgage at 375. The best scenario for refinancing.

Youll break even on the. Choose the best scenario for refinancing. The best scenario for refinancing.

Investors make money by depositing money in the business and depending if the business does well the investors receive money back in the future. Choose the best scenario for refinancing. Choose the best scenario for refinancing.

The answer is a. Question 3 Of 10 Choose The Best Scenario For Refinancing. The best time to speak with an HFA is at the beginning of your mortgage journey or anytime you would like assistance or advice determining the best path forward in property.

Apr 01 2022 0532 PM. Multiple choice questions are. You have a current mortgage at 5 and have been approved for a new mortgage at 375.

3 on a question. You have a current mortgage at 5 and have been approved for a new mortgage. You have a current mortgage at 5 and have been approved for a new mortgage at 375.

You have a current mortgage at 5 and have been approved for a new mortgage at 375. Youll break even on the. Youll break even on the.

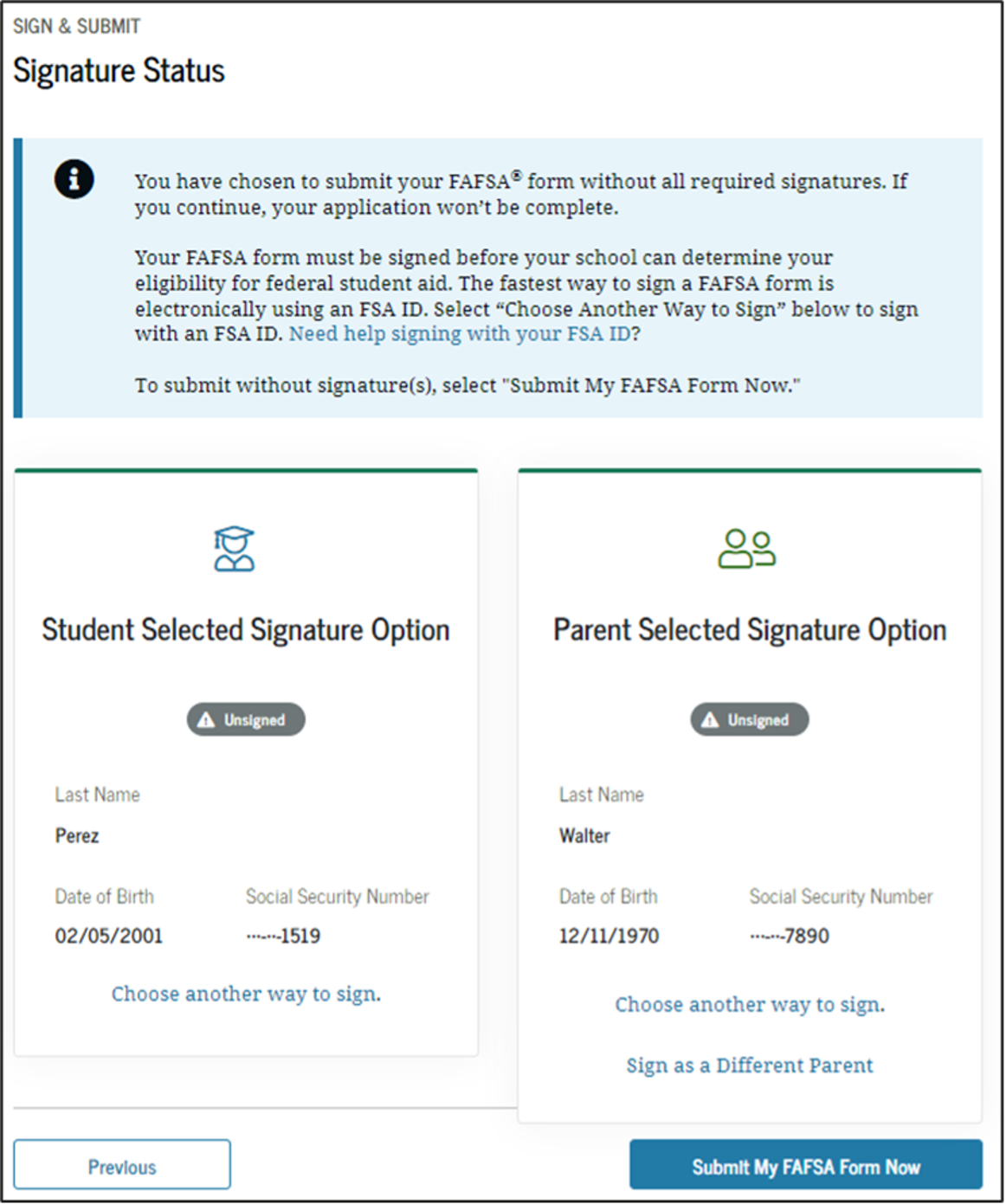

How To Complete The 2023 2024 Fafsa Application

Bringing It Home Raising Home Ownership By Reforming Mortgage Finance Institute For Global Change

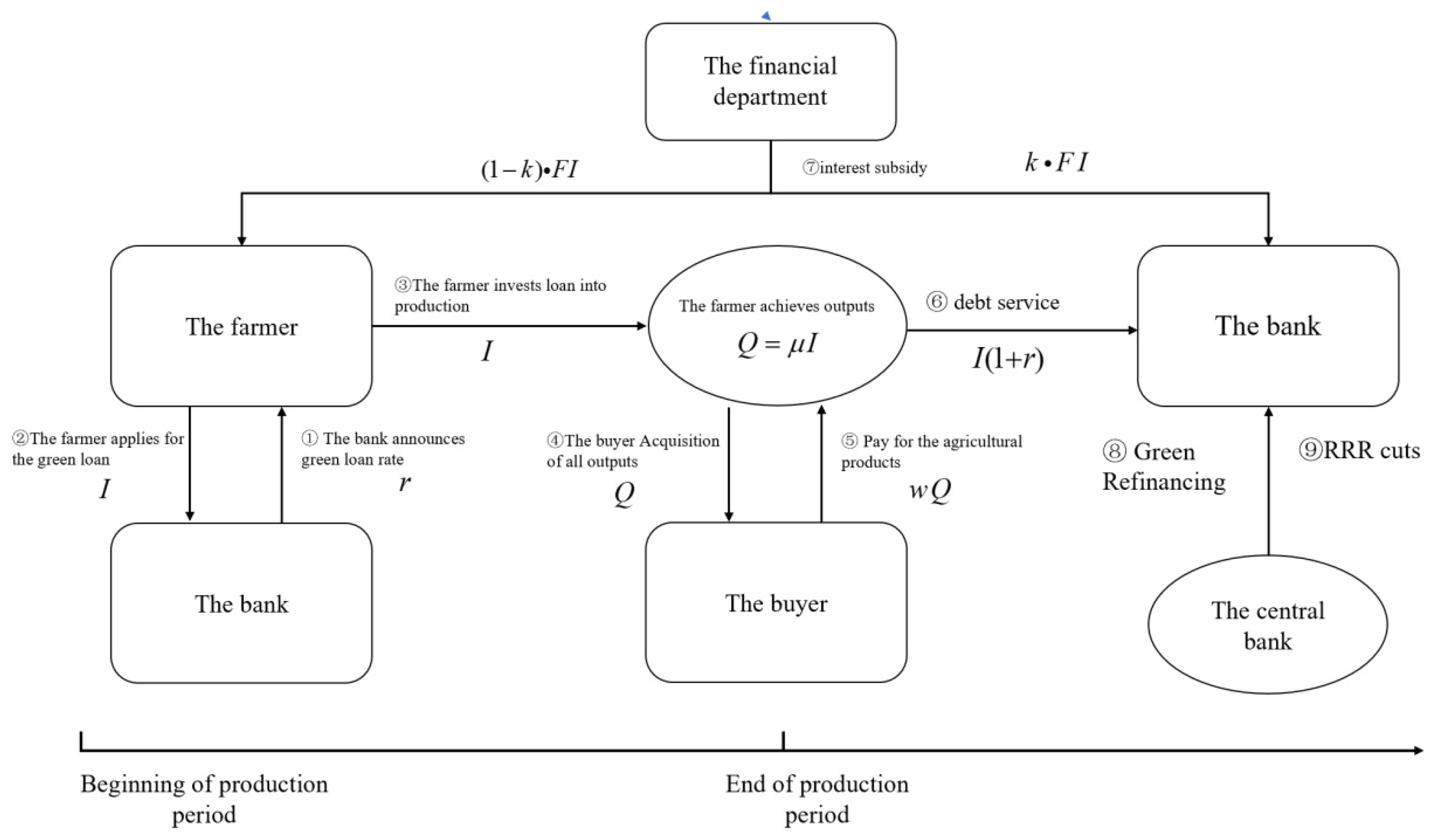

Sustainability Free Full Text Optimal Loan Pricing For Agricultural Supply Chains From A Green Credit Perspective Html

Home Equity Loan Or Heloc Vs Cash Out Refinance Nerdwallet

Mortgage By Zillow On The App Store

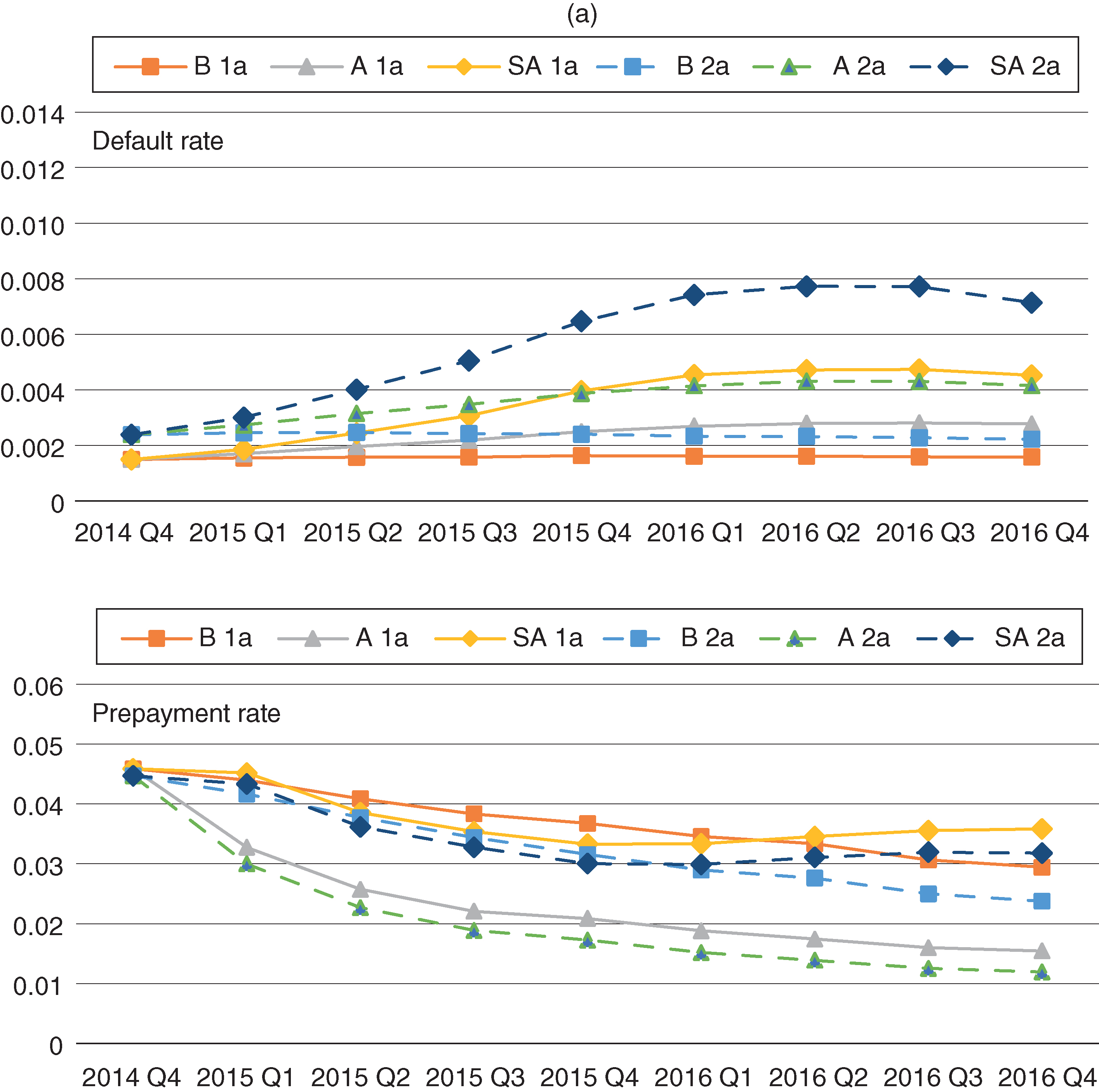

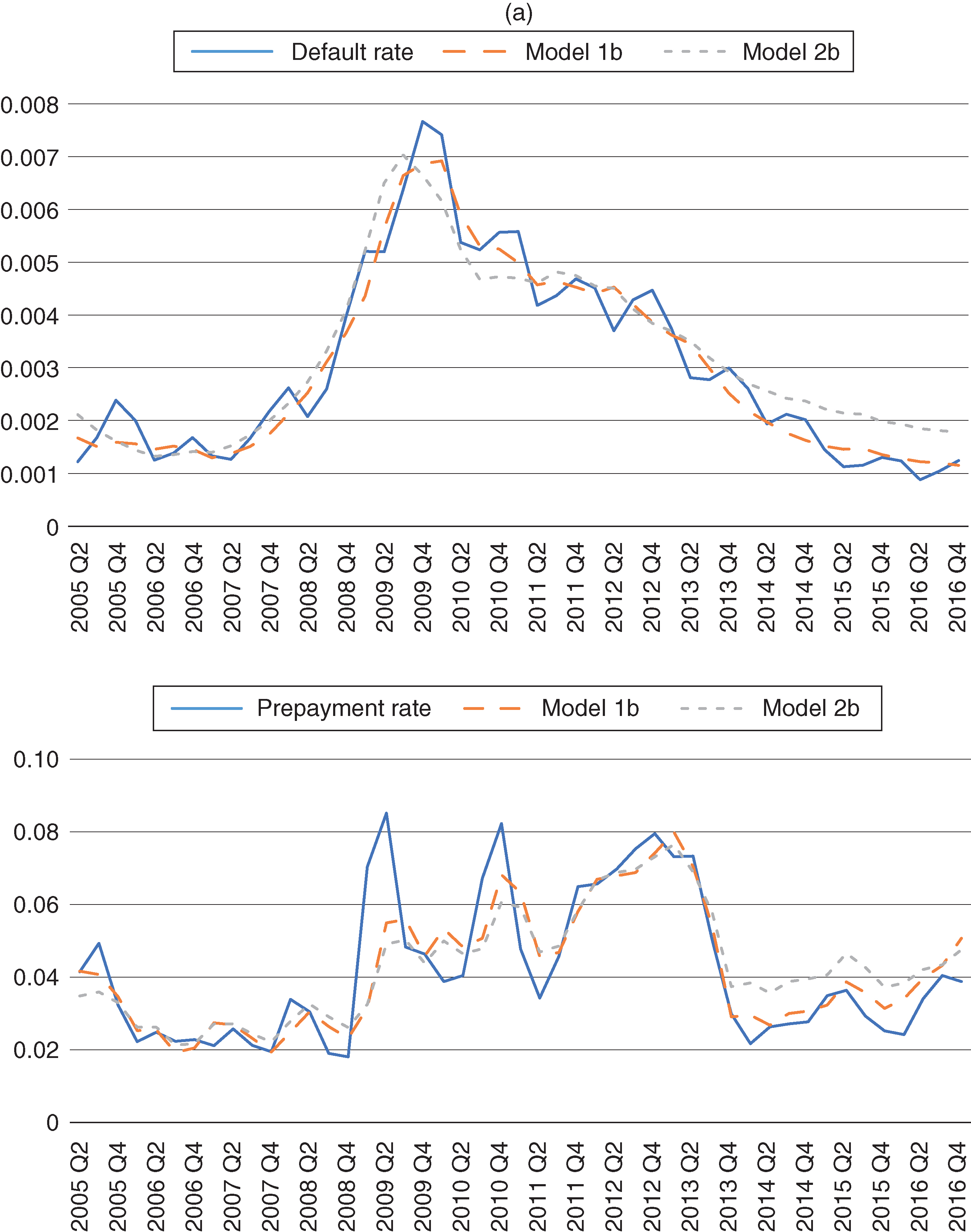

The Impact Of Data Aggregation And Risk Attributes On Stress Testing Models Of Mortgage Default Journal Of Credit Risk

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

Resurfacing Credit Headwinds S P Global Ratings

Christopher Ladley Mc Cladley Twitter

How To Get A Mortgage 7 Steps To Success Forbes Advisor

Fiscal Panorama Of Latin America And The Caribbean 2021 By Publicaciones De La Cepal Naciones Unidas Issuu

The Impact Of Data Aggregation And Risk Attributes On Stress Testing Models Of Mortgage Default Journal Of Credit Risk

Medium Term Debt Management Strategy In Technical Notes And Manuals Volume 2019 Issue 002 2019

How To Choose Financial Planning Software Forbes Advisor

How To Choose The Best Student Loan Repayment Plan For You Student Loan Hero

Solved Question 3 Of 10 Choose The Best Scenario For Chegg Com

Repo Rate Rise Should You Choose A Fixed Interest Rate Home Loan Business News The Indian Express